Let me take a scenario on a Retail shop. Normally shop owners buy the different kinds of products to keep it in their shop. First, they buy the products with small amounts, and later on they will add the quantity if the customers are interested in those products. If the customers are not interested in any of the product, they keep in the ON SALE area and want to rid of those products from the shop as soon as possible.

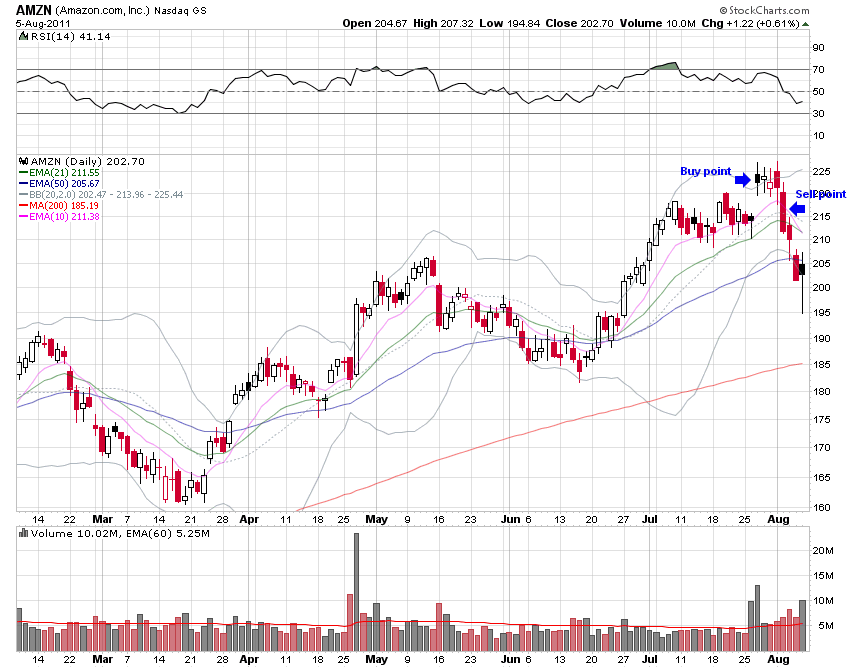

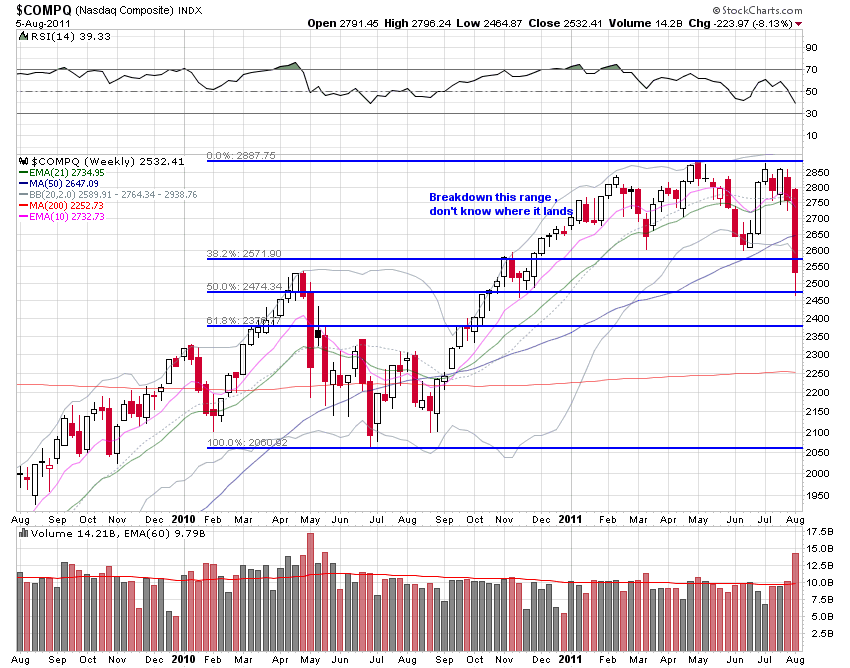

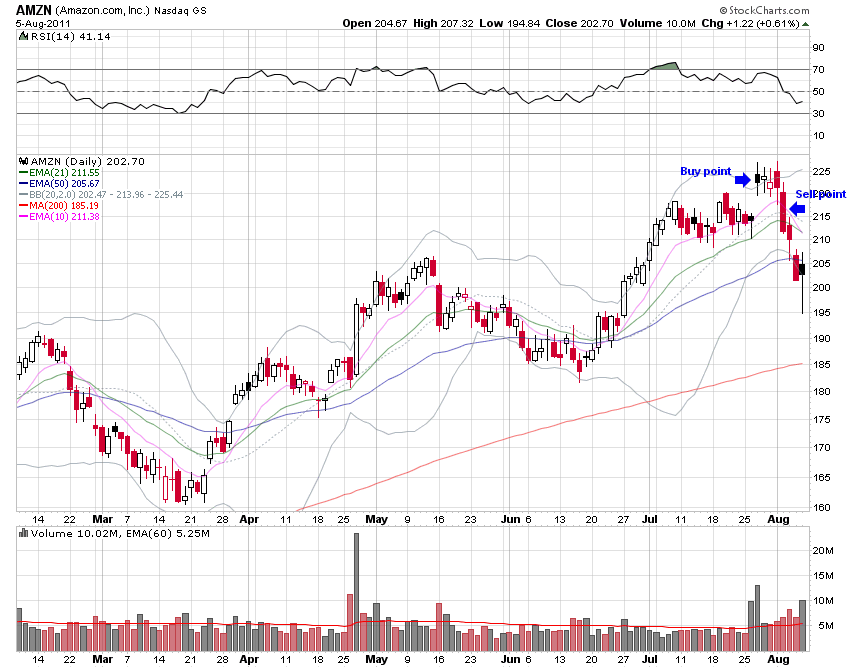

Same principle works in managing the stocks. Initially you need to buy quality stocks with very small amounts, if it is acting well and going up as you expected, then you need to add more. This is called Pyramiding. If it is going against you, then you need to sell immediately by taking small loss.

If you don’t take losses short and keeping un-favored stocks in the portfolio for a long time and it will lead you big losses. Even in the shop, owners won’t piled non-saleable products for a long time. I have seen some people are holding Citi Group (C), Bank of America (BAC) etc for a long term and eventually they take big losses. They don’t have good earnings, sales and still they are holding, because they like those stocks.

Owners should not like the product in the shop, it is the consumers should like the product and they decide whether to keep in the shop or not.

It is same in the case of stocks. You should not like the stock and , moreover, buyers should decide whether to keep it in your portfolio.

You need to take the 5-8 % risk for any stock. If you are risking the more than 8% with your buy point , then there is something is wrong with YOU. If any stock is breaking down more than 8% with proper buy point, then the stock is not ready to move up at that moment. You can buy back later if it sets up.

If you apply this simple principle in real scenario, you will succeed in any business.