Yes. Nature tells everything if you observe closely.

For example, every year there is a spring, summer, winter and fall. Once season starts, it will stay for a while. The season changes very slowly it will take either 1 or 2 weeks, but definitely not in a day. When the season starts to change, you will see one day you feel like cold, other day you feel like hot , another day you will see rain and sometimes it would be both cold and hot etc. There is little bit of turbulence or whipsaw in the weather before it actually starts the season.

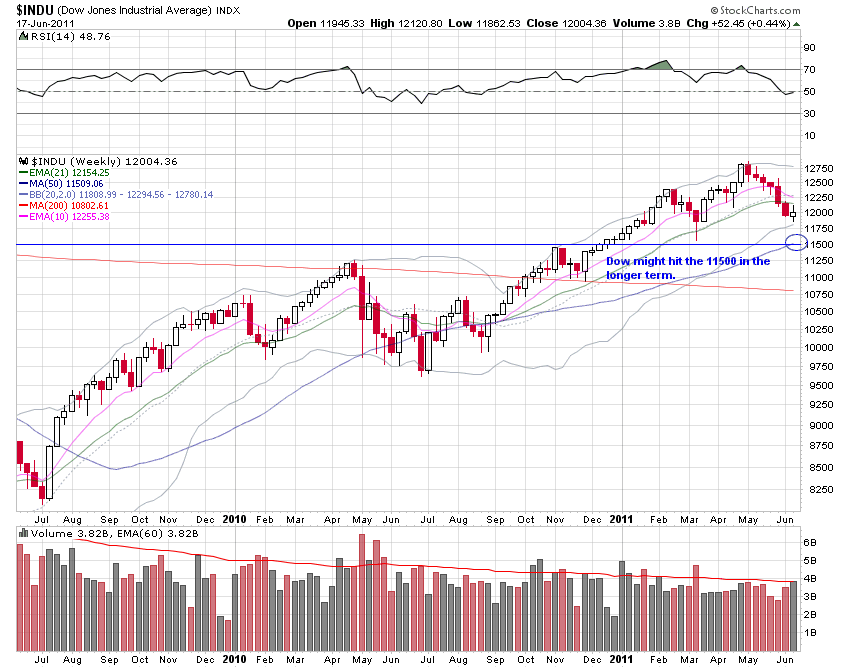

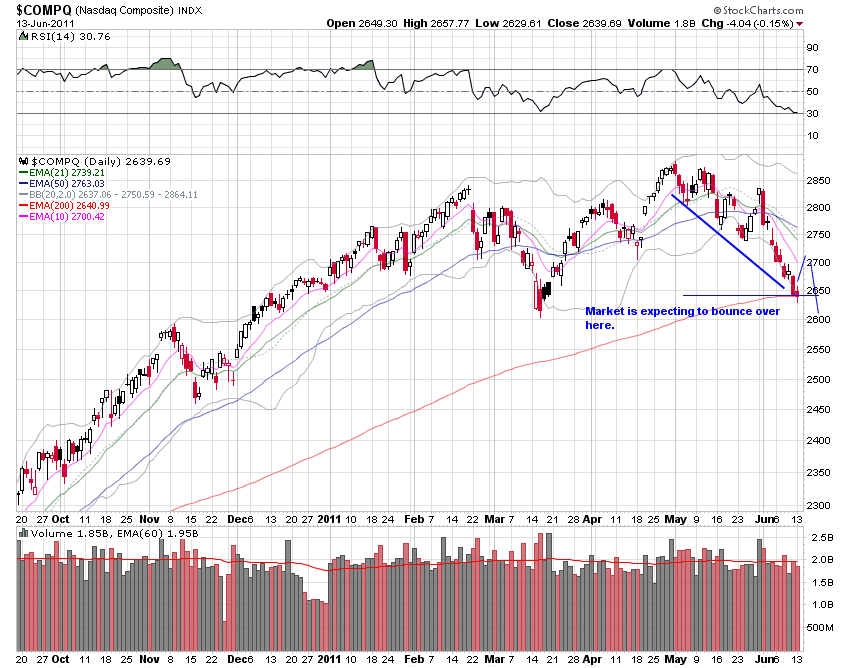

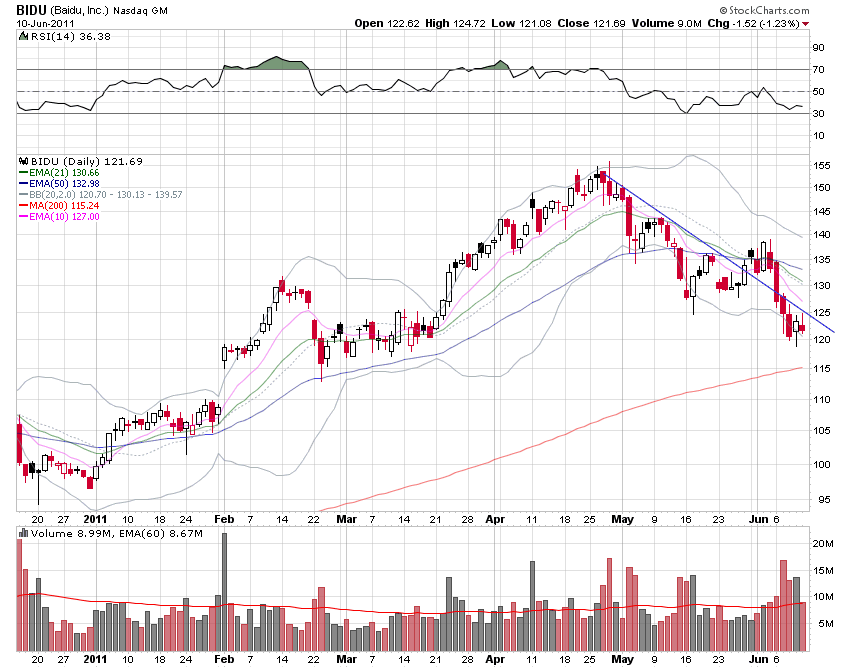

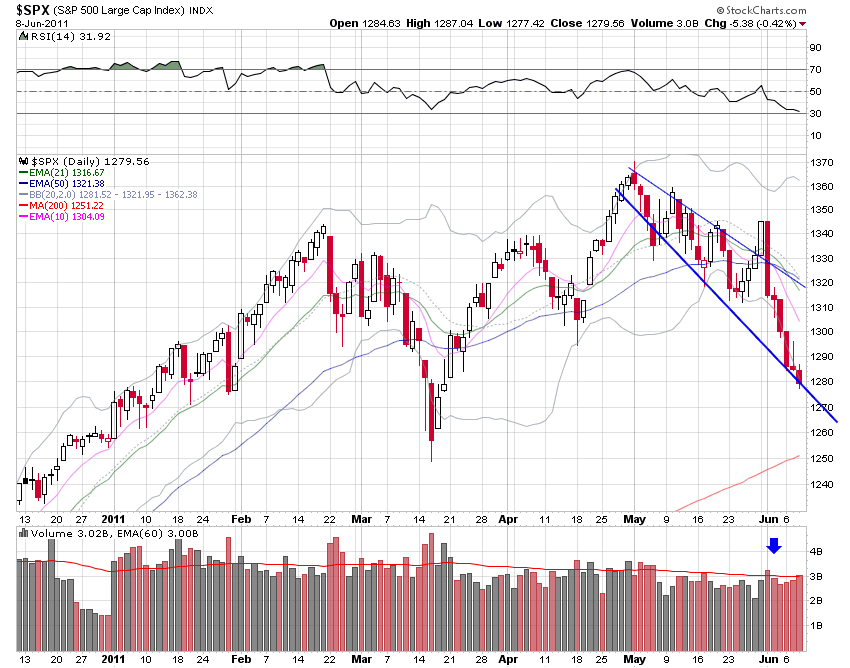

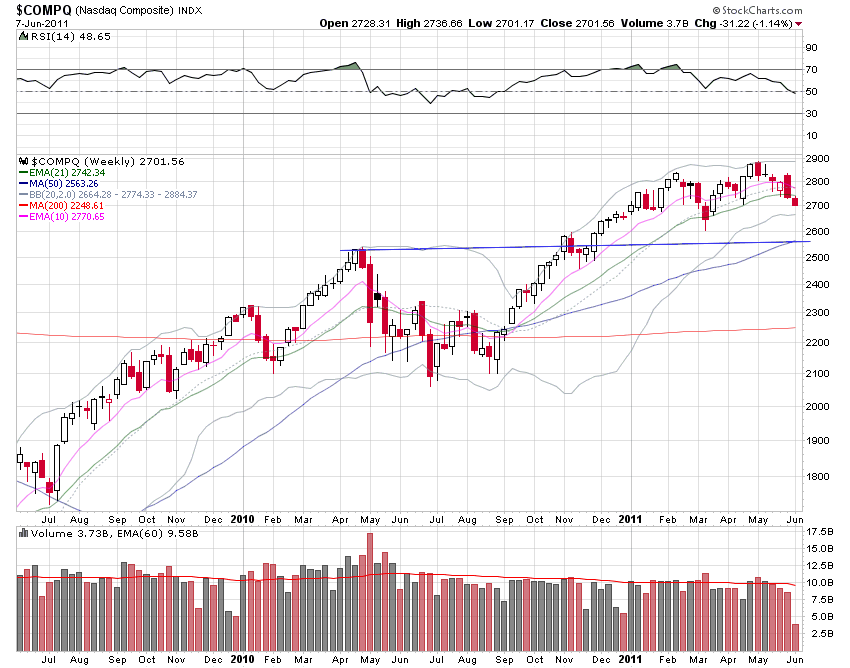

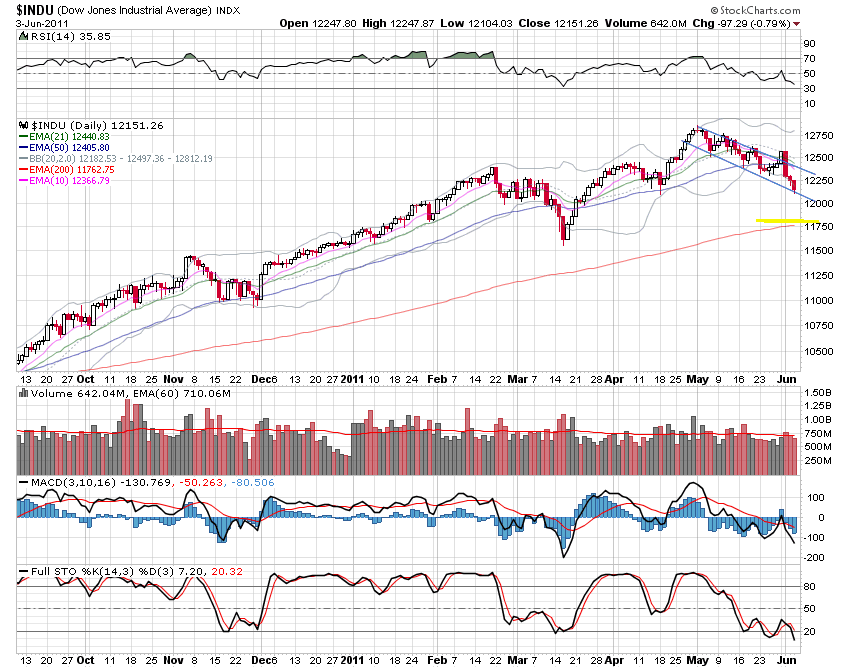

This is exactly with the Stock Market. Trend (Bull or Bearish) will not change in a day. It will take a while to change either bullish or bearish. When it tries to change from bullish to bearish, there will be lot of up and down days before it trends to bearish. Same in the case of bearish to bullish. There will be tough war between bulls and bears to determine the direction of trend. If trend starts, it will continue for a while. Most of the people will be overlooking and feels like market corrects at anytime. However, it never happens.

How can you determine whether the trend is changing?

It’s dead simple. For example if you take the above example, when the season changes to summer, what can you observe?

The temperature increases day after day. You can feel the high temperatures in 1 or 2 days during the starting of the season. But It is not continuously. It will take a while to feel high temperature days. When the season starts to ending, then there will be 1 or 2 days temperature drops and after that the next season takes off.

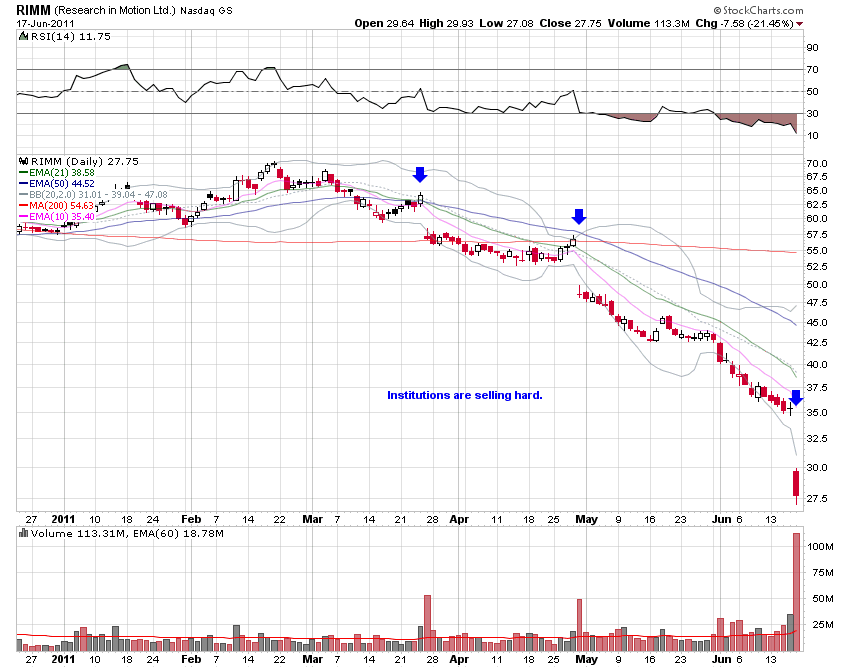

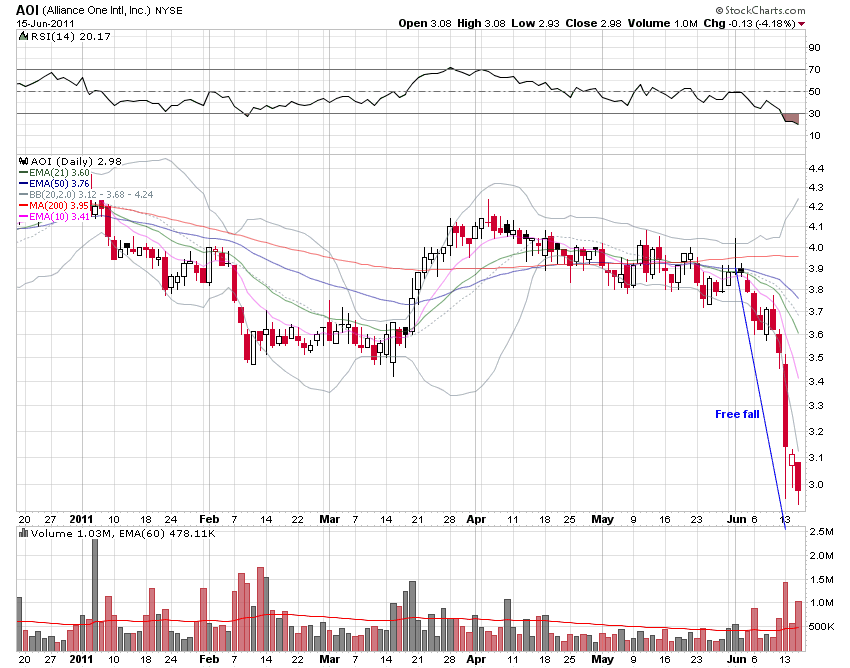

Exactly same principle applies to Market. You can see the 2 or 3 up days before market changes to bullish mode and bull trend continues afterwards. In the market terminology, it will be ‘Follow thru’ day. Mutual funds, Hedge funds and other institutions are putting money into the market once they see the market character is changing. They are continuously investing with small amounts. So like that, you can see the lots of stocks are breaking outs at that time. For example, if you see the stocks are breaking out either 4% or 5% or 6% continuously, then there will be indication that the major institutions are putting money into the market. This is what called ‘Market Breadth’. And also, Institutions won’t take out money in a day, because they handle with millions or billions of money. They will take out with regular intervals. Same in the case of Bearish trend.

Sometimes, you can observe that there will be 1 or 2 big down days in a uptrend. That’s fine , if you are sitting in the good fundamental stocks, it will come up easily. Because market breadth won’t affect that fast. If you take the above example, you can see there will be heavily rainy days during summer, it doesn’t mean summer is ending.

All books are telling same thing in a very complicated manner.

Nature reveals subtle truths if you observe closely….